Summary

What is the role of financial regulation? Can macroprudential policy achieve its objective of mitigating systemic risk? And what lessons for financial regulation can be learned, both worldwide and in Denmark, from the global financial crisis? On November 3, 2017, Mr. Jesper Berg, Director General of the Danish Financial Supervisory Authority (FSA), presented his views on these questions at an open JVI event, chaired by JVI Director Thomas Richardson.

Why financial regulation and supervision?

Mr. Berg began by reviewing some market imperfections that explain why financial regulation is necessary. He then offered options to limit the inherent risks related to the intermediation function of banks, which is to transform short-term liabilities into long-term assets. Among traditional options are deposit insurance, the central bank lender-of-last-resort function, and financial regulation to limit risk-taking and ensure that liquidity and capital buffers are on hand. More recently, changes to bank business models have been proposed, such as narrow banking and ringfencing (to separate retail deposit-taking and granting of loans from other financial intermediation activities), and—like mutual funds—changing the deposit contract so that the value of deposits changes as asset values change. As an example, he presented the Danish model, in which mortgage loans are fully funded by long-term covered bonds, which completely removes the maturity mismatch risk.

Macroprudential policy

There are often high expectations, Mr. Berg said, that macroprudential policy can limit and mitigate the risks of large financial disruptions, but it is advisable to take a more cautious approach. He suggested that each policy be thought of in terms of connecting with a pitch in a baseball game: it is necessary to “see the ball, have the skills to hit it, have the guts, and have a bat.” In practice, it is not possible to really know what risk may bring about the next financial crisis (not seeing the ball); we may not have all the skills necessary to analyze it properly, since understanding of the analytical underpinning of macroprudential policy is still at an early stage; we may not have the guts, given the very complicated committee-type structures that make decisions about macroprudential policy; and we may not have available well-developed, effective, and arbitrage-free policy tools (the bat). On the other hand, there has been progress in understanding both micro-prudential and macro-prudential policies, and we are doing much more to think countercyclically and make sure that banks are better capitalized in good times to prevent deleveraging in bad times.

Unique features of the Danish financial sector

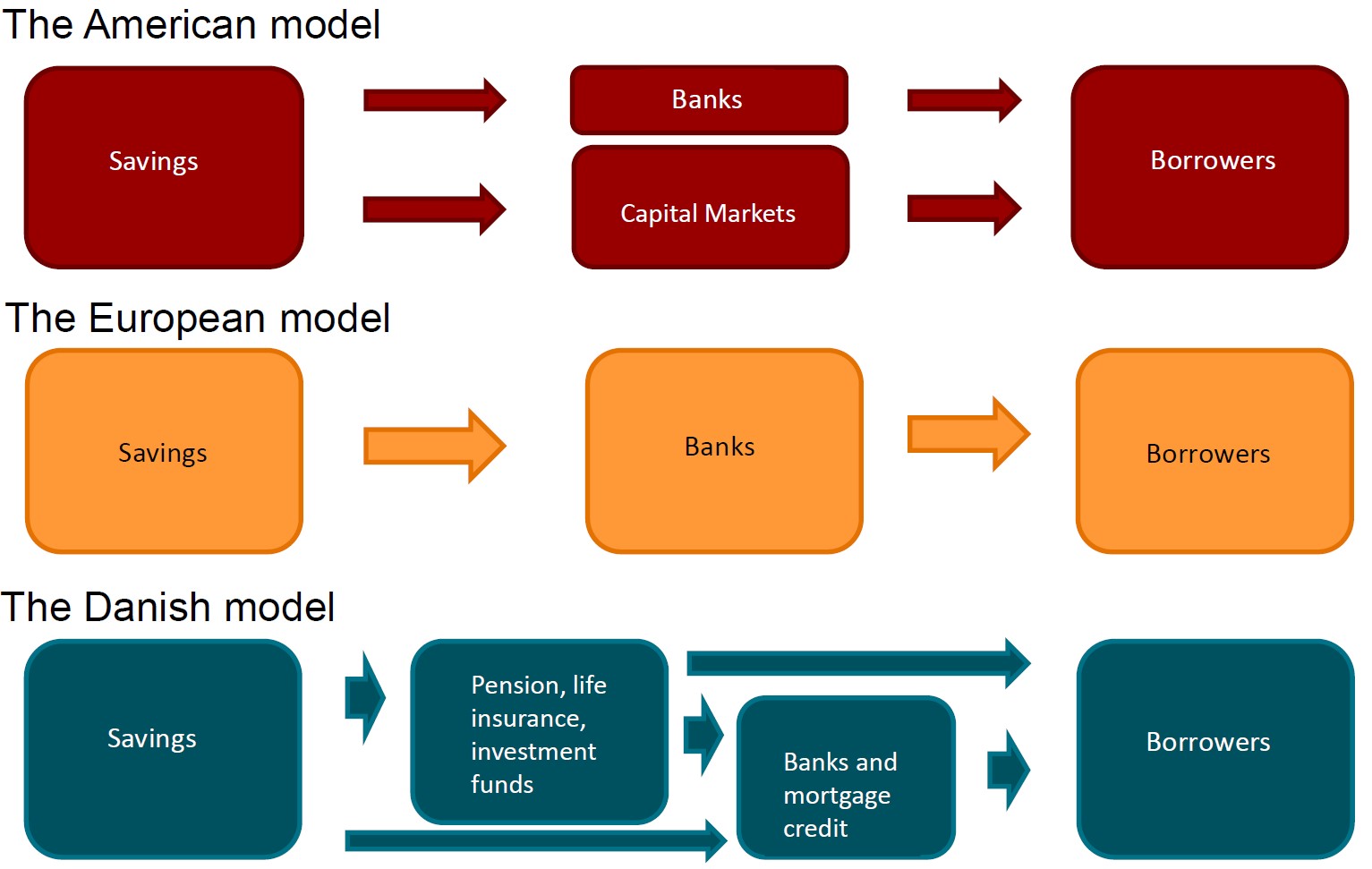

Mr. Berg then moved on to describe unusual features of the Danish financial system: Denmark is an outlier on pension and mortgage credit, pulling together a combination of aspects of the bank-based European and the markets-based US systems (Figure 1). The relative size of the banking sector, including mortgage banks, is about 400% of GDP, larger than in most other countries. The Danish mortgage banking model is very stable, mitigating almost all asset-liability-management risks except credit risk. Long-term mortgages are funded by issuing long-term mortgage and covered bonds that follow the balance principle – cash flow on the loan is directly linked to cash flow on the bond issued to fund the loan. Because bonds are issued daily to fund new loans, there is no pipeline risk. Credit risk is also limited because losses are low due to a swift foreclosure process, price transparency, and standardization. However, this banking model does not always mesh well with international banking regulations.

The FSA strategy through 2020

Mr. Berg described the impact of the global financial crisis on Denmark: Compared to its Scandinavian neighbors, which went through a major crisis in the early 1990s and weathered the 2008/2009 crisis quite well, Denmark suffered much more than, say, Sweden or Norway, because the crisis hit when the country’s banking system had low liquidity and capital buffers. The number of banks decreased from 145 in 2007 to 74 in 2017, with most of the exits for the usual reasons: high growth in loans at the expense of quality, misjudgment of credit risk, heavy concentration, exposure to risky industries, and reliance on short-term funding. Today, banks need to be much better capitalized than formerly. Given the recent changes in bank resolution procedures in Europe based on the bail-in principle, to prevent losses to depositors, Danish banks need to build additional buffers of 3.5% to 6% of risk-weighted assets by issuing bonds subordinated to senior claims (tier 3) and convertible to equity if resolution becomes necessary.

The FSA strategy through 2020, labelled “Justified Confidence,” is based on the view that supervision should have a systemic perspective, be sufficiently prudent in good times, and focus more intensively on new areas, such as tech-based financial business and cyber risk. In supervising pension funds, which constitute about 50% of GDP, the FSA is emphasizing consumer protection, especially in the ever-growing area of unguaranteed products. Customers should be told what return is expected and given estimates of possible downside and upside risks; however, the product characteristics and risk management issues are still being debated.

Adam Gersl, Senior Economist, JVI