Summary

On May 20, 2019, the JVI hosted a public lecture by Gaston Gelos, assistant director, IMF Monetary and Capital Markets Department. Mr. Gelos introduced a comprehensive new IMF database of macroprudential policies, iMaPP, published in a recent paper, “Digging Deeper-Evidence on the Effects of Macroprudential Policies from a New Database.” The database covers data for 134 countries from 1990 to 2016. Based on numerical information from the database on loan-to-value (LTV) limits, the results point to economically significant and nonlinear effects, and a declining impact for large tightening measures. The initial LTV level also appears to matter; when LTV limits are already tight, the effects of additional tightening on credit are dampened but the effects on consumption are strengthened.

Mr. Gelos began by emphasizing how important macroprudential policy measures are for limiting systemic risk․ Since the global financial crisis, macroprudential tools have been much more widely adopted not only by advanced economies (AEs) but even more by emerging markets and developing economies (EMDEs). The financial community has been taking substantial steps to make the financial system more resilient to shocks, contain the build-up of systemic vulnerabilities, and control the vulnerabilities caused by “too important to fail” institutions.

The literature that studies the impact and effectiveness of various macroprudential measures is growing rapidly, however, challenges remain, and Mr. Gelos noted that, drawing on iMaPP, he and his co-authors are attempting to make progress on resolving these issues:

(1) Empirical findings tend to be fragmented due to different samples and different definitions of macroprudential policy instruments. To address this issue, Mr Gelos and his co-authors constructed iMaPP, which is the most comprehensive database on macroprudential policies yet available. iMaPP covers monthly data on 17 categories (dummy-type-indices) of macroprudential instruments applied in 134 countries from 1990 to 2016. The co-authors plan to update the database annually drawing on the IMF’s Annual Macroprudential Policy Survey. Analysis based on iMaPP data confirms that loan-targeted instruments have a significant constraining impact on household credit, and a milder dampening effect on consumption.

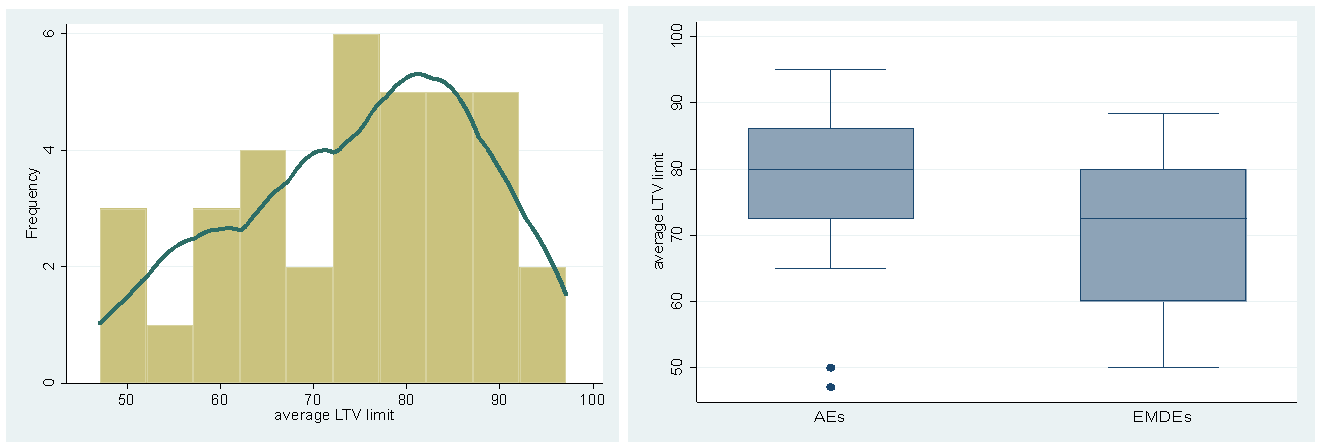

(2) Most published empirical studies on the effects of macroprudential policy measures are qualitative rather than quantitative, because dummy-type policy indicators are used without taking into account the tightness of the policy stance or the intensity of taken policy actions. To address this issue, the iMaPP provides regulatory limits on LTV ratios in addition to dummy-type variables. LTV limits are one of the most widely used macroprudential instruments, and monthly data are available for 66 countries, starting from January 2000. Figure 1, left panel, illustrates the histogram of the average LTV limit, conditioned on the use of the LTV regulation. It shows a wide range of values, about 50% to 95%. Figure 1, right panel, shows the distribution of average LTV limits by country group (AEs and EMDEs) and suggests that LTV limits tend to be stricter for EMDEs.

Figure 1: Average LTV Limit, Distribution in December 2016

(3) There are often concerns about the endogeneity of policy measures taken. Using the numerical information on regulatory LTV limits in the iMaPP database, the paper quantifies the effects of percentage point (pp) changes in LTV limits. To address endogeneity issues, an augmented inverse propensity-score-weighted estimator is used. The results imply that per-unit policy effects are nonlinear with respect to the intensity of the policy change and the initial LTV level. Thus, for a tightening by less than 10 pp, the authors found that real growth in household credit falls by 0.7 pp after 4 quarters. However, the per-unit effect is smaller at 0.4 pp for larger tightening of LTV limits, likely reflecting increasing policy leakages. The effects on consumption appear to be smaller and less robust. The initial tightness of LTV regulation also seems to have an impact. When LTV is already tight, effects on credit growth are smaller but side-effects on consumption growth are larger. Mr Gelos inferred that, when LTV limits are already tight, additional down-payment requirements may no longer be covered by existing savings, which constrains more households, which in turn makes consumption responses larger. These results suggest that, rather than further tightening the LTV limits, countries with already strict LTV limits might be better off considering other macroprudential tools so as to contain credit growth with fewer side-effects on consumption.

After the presentation, the audience raised a wide range of questions regarding the construction of the new database and the empirical analysis presented in the paper. Mr. Gelos emphasized that there is plenty of room to exploit the richness of the database and shed light on macroprudential policy measures that can affect both financial stability and more broadly welfare analysis.

Maria Arakelyan, Junior Economist, JVI