In general, the resilience of large euro area banks has improved and, as the FSAP solvency stress tests suggest, capital buffers are now generally sizable enough to counter current risks. However, serious vulnerabilities remain: (1) Despite recent improvements, progress in reducing nonperforming loans and raising provisioning has been uneven; (2) While funding has become more stable as banks rely more on retail deposits, some banks still rely heavily on central bank refinancing; (3) In some countries, households, nonfinancial firms, and government are severely indebted, making them vulnerable to a tightening of financial conditions; (4) Commercial real estate prices have risen markedly in some large cities, while residential real estate prices appear overvalued in certain areas. Finally, there are some indications that credit and market risks are being underpriced, particularly in fixed-income markets. In identifying possible risks, the FSAP explored the possible short-term and long-term impacts of Brexit, cyber risks that could include large-scale disruptions ot financial infrastructure, and data gaps related to other financial intermediaries, commercial real estate prices, and characteristics of loans to households.

By any measure the profitability of may banks is low, Mr. Hardy noted. The ongoing economic recovery is supportive of bank profitability, but it is unlikely to resolve the structural problems of the least profitable banks, which might over the medium term be forced to leave the market. As for liquidity, the FSAP comprehensive analysis of the structural liquidity ratios of large banks was complemented by a variety of cash flow–based liquidity stress tests. All banks meet the 100% minimum Liquidity Coverage Ratio (LCR) requirement but some are vulnerable to risks related to foreign currency liquidity and funding concentration.

Banking Sector Oversight

The supervision of euro area banks has improved significantly under the Single Supervisory Mechanism (SSM), which has successfully established its operational independence and effectiveness, intensified the supervision conduct and harmonized supervision practices at a high level. Nonetheless, Mr. Hardy said, challenges remain, such as inadequate control of supervisory resources, which are spread across national supervisors; still-heterogeneous national legislation; complex decision-making and insufficient delegation; and the need to give more attention to the regulation and supervision of liquidity risk, which the FSAP identified as of particular concern for some banks. [Finally, addressing the persistence of nonperforming loans (NPLs) in some member countries must remain a supervisory priority. Beyond that, common definitions of NPL, minimum standards for insolvency and creditor rights, and rules for valuation of collateral would accelerate resolution of NPLs.

Bank Resolution and Crisis Management

Mr. Hardy explored the challenges related to establishing EU-wide bank resolution and crisis management. The FSAP acknowledged that this part of the banking union has been reinforced considerably in recent years, but there is work to be done to complete, unify, and simplify the regime. Adoption of the Bank Recovery and Resolution Directive (BRRD) and Single Resolution Mechanism Regulation (SRMR), and the creation of the SSM and the Single Resolution Mechanism (SRM) provide a foundation for dealing with problem banks, but recent cases of bank intervention demonstrate that there are still incentives to use approaches other than SRMR/BRRD resolution that have less-stringent burden sharing. Thus, treatment of bank creditors diverges depending on where intervention takes place.

Mr. Hardy suggested that part of the challenge is operational: the authorities need to have the capacity to pre-schedule the “resolution weekend” when a possible problem bank is intervened and resolved with minimal disruption to others, using streamlined decision-making. The FSAP includes a number of other recommendations in this area. One element relates to financing: a stocked-up resolution fund, with a backstop; funded national deposit insurance systems (DIS); and a European Deposit Insurance Scheme to underpin national DISs are all needed. Those are some of the elements that would contribute to ensuring the availability of adequate liquidity in the course of bank resolution. The timely build-up of loss-absorbing capacity in banks (so-called MREL) is needed to ensure that that there are sufficient liabilities and debt instruments that can be credibly subjected to bail-in. The FSAP also recommended that the Single Resolution Board have available an administrative bank liquidation tool, and that the EU state aid loss-sharing requirements and those in the BRRD be better aligned to help reduce fragmentation and make the common resolution framework more effective. This alignment should be done after introducing a financial stability exemption—to be used only in times of widespread crisis and subject to strict conditions and governance arrangements—which would allow, for example, relaxation of mandatory bail-in requirements for accessing financial resources to support resolution when needed to reduce contagion risk.

The Euro Area Perspective

Mr. Reading of the OeNB considered the euro area FSAP to have been a very useful exercise, conducted in a collaborative way with national and European authorities. In his opinions, the SSM has had impressive achievements considering that it was not set up until 2014; its first project was the Asset Quality Review, which brought more transparency into the euro area banking sector. The EU authorities are aware that the enormous complexity of financial regulation and resolution is largely driven by requirements of the member states in achieving a EU-wide compromise. However, the framework is further evolving and will hopefully be simplified along the lines proposed by the FSAP.

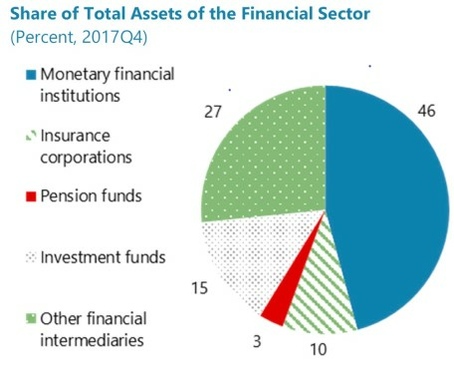

Mr. Grafl of the FMA said that the implementation of the SSM has been a major milestone in strengthening Banking Supervision all over Europe, with major restructuring and capitalization efforts experienced in the banking sector. While authorities and banks will be well prepared for future resolution cases, a major crisis with more than one bank failing might pose a challenge to the complex regulatory and institutional framework. He saw a need to be aware of new risks to financial stability, such as tighter financial conditions, policy uncertainty and less-regulated shadow banks.

General Discussion

The discussion that followed considered the role of macroprudential policy, which in the EU is still largely national; past cases of bank failures and resolutions, such as those in Italy and Latvia; the costs and benefits of non-euro-area countries voluntarily joining the SSM; the heterogeneity in the business models of EU member states; and liquidity regulation when there is reliance on foreign currency (mainly US dollar) funding.

Adam Gersl, Lead Economist, JVI