Summary

Profit-shifting and tax competition are major concerns under the international corporate tax system, with digitalization creating new challenges. Developing countries, which rely more strongly on corporate income taxes, are at particular risk. Thus, globally, faith in the fairness of the whole tax system is undermined. Proposals that could change current norms fundamentally are on the table. A recent IMF Policy Paper, “Corporate Taxation in the Global Economy,” analyzes the economic consequences of these proposals and their policy and governance implications. On May 22, Mr. Alexander Klemm, an IMF economist and one of the authors, discussed the findings in a public lecture at JVI.

The Major Problems

First, despite substantial progress in multilateral tax coordination, profit-shifting by multinational companies is still significant. Estimated revenue losses for advanced economies reach up to a third of collected corporate taxes. For developing countries, given their higher dependency on corporate taxes, losses can be even higher. Common rules under the G20/OECD Base Erosion and Profit Shifting (BEPS) Project, such as those based on the “arm’s length principle,” are not able to prevent all profit-shifting.

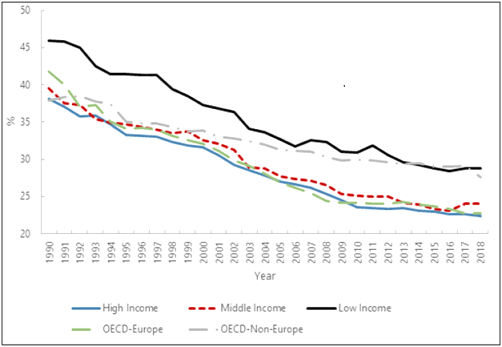

Second, tax competition has led to three decades of decline in corporate tax rates across high, middle, and low-income countries alike (see Figure 1). The revenue losses are arguably even greater than those from tax avoidance.

Figure 1. Trends in CIT Rates

Third, low-income countries lose revenue they need to reduce poverty, achieve higher economic growth, and meet the 2030 Sustainable Development Goals. In part, their heightened vulnerability is due to their higher reliance on corporate income tax (CIT) revenue. Alternative revenue sources like VAT are difficult to expand in economies with considerable informality. Moreover, the complexity of the new global standards and common approaches is particularly challenging for countries with developing tax administrations and diverts attention from pressing domestic tax issues. Finally, because many multinational companies operate in low-income countries but only few are headquartered there, these countries’ interests are quite different from those of advanced economies in terms of taxation rights, but so far they have had less influence on global standards.

Fourth, because of digitalization, physical presence is no longer a prerequisite for doing business, and the consumer participates in value-creation. Countries with many consumers of digital services increasingly find themselves with little or no tax revenue from highly profitable multinational digital companies. Some countries use digital service taxes as an intermediate solution, but as yet there is no consensus at the OECD level.

Possible Solutions Analyzed

What alternatives could better address these harmful effects? While the advantages and disadvantages of the different proposals depend heavily on their design, Mr. Klemm gave some general guidance:

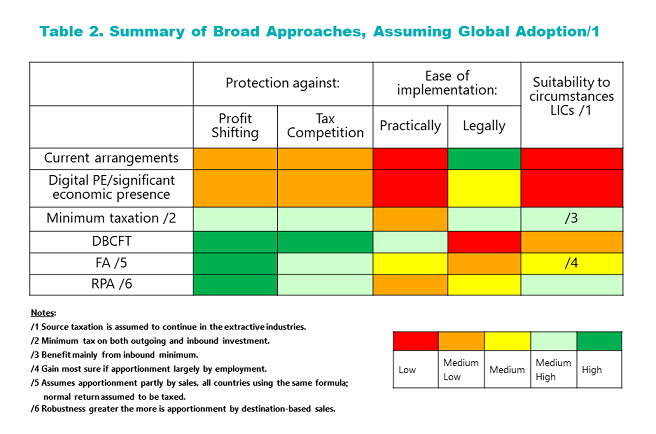

- Minimum tax schemes ensure at least some taxation of profits and target profit-shifting. They can apply to either outbound or inbound investment and reinforce an element of worldwide taxation while maintaining current country tax rates. However, as seen in Table 2, their core disadvantage for tax authorities is their complexity because of having to identify the tax paid abroad and the effective exchange of information systems that are required.

- Destination-based cash flow taxes are more revolutionary: they allocate taxing rights to the jurisdiction in which the purchaser is located. Because the system would exclude exports and include imports, in the short run it favors countries with a trade deficit. Moreover, it would thus be robust to profit-shifting, which would in general benefit developing countries. For resource-intensive countries, special treatment of extractive industries would be required. Given the expected major redistribution of tax revenue between countries, with distinct winners and losers, global adoption could be difficult to agree on, but unilateral adoption would lead to very negative spillovers.

- Formula apportionment methods, which distribute consolidated corporate profits across jurisdictions where a multinational company operates according to a formula, would eliminate profit-shifting but may distort companies’ structural decisions, and possibly intensify tax competition. Furthermore, because they depend on the weighting factors used for apportionment, the distributional effects are unclear. Developing and emerging economies might benefit from this proposal if apportionment is largely by employment and sales.

Outlook

During the question and answer session, a main concern was whether any such change is feasible, given the power (im)balance and the absence of a global tax governance system with developing and advanced countries both fairly represented. A shift in the corporate taxation system in the direction of a destination-based cash flow tax therefore seems unlikely. Minimum taxation schemes were seen as most similar to current arrangements and thus most likely to be accepted.

Barbara Dutzler, Senior Economist, JVI