Summary

Fiscal policy is not easily understood because it is highly technical. Governments thus have leeway to skew information in a partisan way. Further, political cycles incentivize short-term behavior, which undermines the sustainability of public of finances.

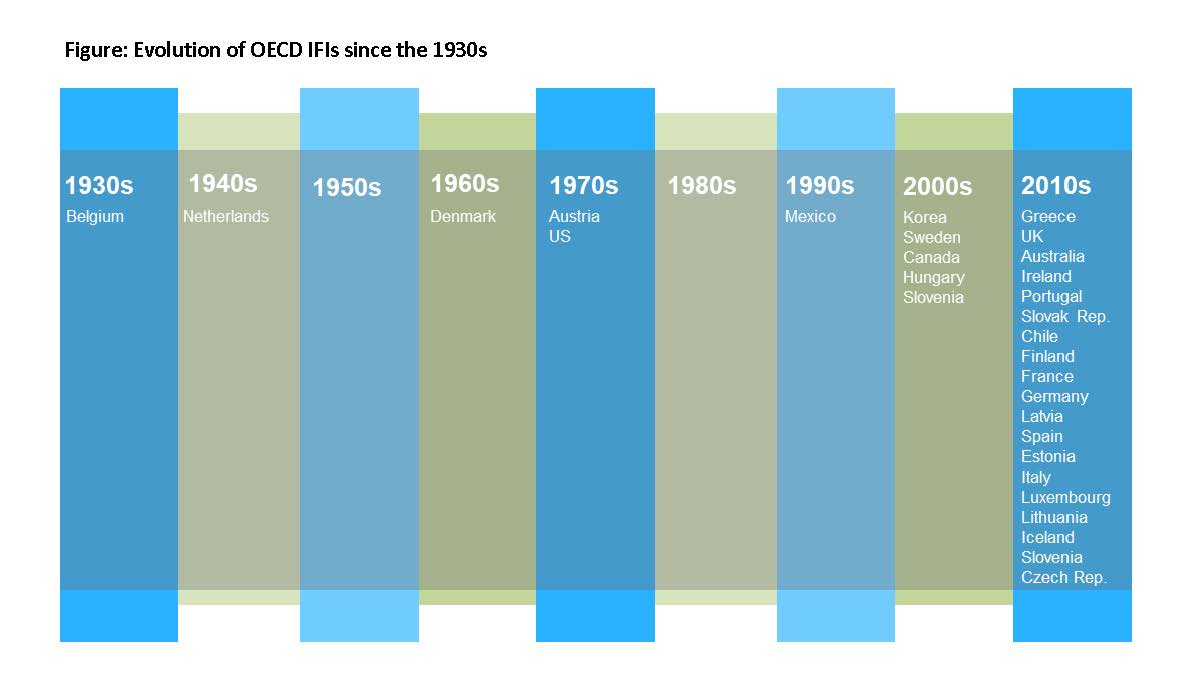

Most OECD countries have recently established independent fiscal institutions, both to foster greater transparency, accountability, and public debate and to promote sound fiscal policy that will keep public finances sustainable. But what challenges do these institutions face in delivering on their mandates? And how can their effectiveness be evaluated?

On February 21, 2020, Ms. Scherie Nicol from the OECD Public Governance Directorate presented fresh evidence of the work of these independent fiscal institutions (IFIs), their successes, and the core impediments that recent OECD peer reviews of these institutions have unearthed.

The Work

For most OECD countries, IFIs are a relatively recent phenomenon (Figure). Their functions range from fiscal forecasting to monitoring fiscal rules to costing policies. Because these functions are so diverse, a number of countries have allocated IFI mandates to several different institutions, with, e.g., Parliamentary Budget Offices (PBOs) tasked with budgetary analyses and fiscal councils doing macrofiscal analysis and forecasting. In resource-rich countries, IFIs may assist governments by reviewing official forecasts of commodity prices.

As IFIs evolve into trusted and valued institutions, OECD countries typically ask them to take on new tasks, such as monitoring fiscal risks, conducting spending reviews, or costing elections. Because these institutions are often under-resourced, new mandates can give them an opportunity to negotiate staffing and other resources. Peer reviews or external advisory panels are common ways to assure quality.

The Wins

In 2014 the OECD adopted Principles for IFIs that give member countries practical assistance not only in setting up these institutions but also in guiding reforms to ensure, e.g., the independence of leadership or financing. In practice, all OECD IFI leaders are appointed based on merit and competence; and almost all are able to set and deliver on their own work programs.

Using a case study of the US Congressional Budget Office, Ms. Nicol demonstrated that leadership is crucial in the early stages of an institution to instill a culture of independence and nonpartisanship, especially when the environment is polarized. A core principle that guides the work of PBOs is to inform political debates by providing analysis but not making any recommendations so as to avoid influencing the outcomes.

Benefits of IFIs adhering to the Principles have proved to be substantial:

- better collection of fiscal and economic data, as government agencies respond to the data requirements of independent review (e.g., Scotland, Portugal);

- more accurate forecasts that enhance budget credibility (Canada);

- increased identification, awareness, and mitigation of fiscal risks (UK);

- improved fiscal management, such as flagging slippages in budget execution (Spain);

- a more orderly budget process (UK);

- better-informed parliamentary debate (e.g., in Lithuania on long-term fiscal sustainability);

- enriched public debate (in Slovakia around pension reform);

- increased fiscal responsibility (in Italy, where because the PBO did not endorse government macro forecasts, the Italian government revised its budget);

- more objective (apolitical) information (Australia).

The Worries

Three main problems can undermine IFI effectiveness: access to information can be a major challenge. IFIs in Portugal and Slovakia have struggled to access key information required to undertake their functions, and in Spain and Canada similar struggles actually led to legal action. When an IFI releases information to the public that gives a different picture from that released by the government, for instance in Canada regarding the cost of the Afghan war, the government may be tempted to restrict access to information. Access to information must be not only clearly guaranteed in the enabling legislation but the means of its enforcement should be specified.

A second concern is the adequacy and security of the IFI’s resources. Typically, the Ministry of Finance is responsible for approving funds for IFIs, which it may regard as potential adversaries, leaving ample room for threats and actual cuts as punishment. It may even effectively close down the IFI, as happened in Hungary in 2011 when funding for IFI staff was cut from 30 to 3 after its critical report on government budgetary policy. Another defensive strategy may be to delay appointment of significant leaders, which leaves IFIs weak and passive.

Finally, IFIs must rely for impact on think tanks, academia, parliaments, the media, and civil society. A watchdog can bark louder if its key messages are amplified by its natural allies. Media can ensure traction for IFIs, as coverage in national press can elicit a response from government.

In her concluding remarks, Ms. Nicol emphasized the importance of not only good design choices from the start but also a proactive approach to communication to help protect these institutions and support their good performance. In the lively debate that followed her presentation, the audience suggested endowment funds or other innovative funding sources. However, Ms. Nicol reiterated the importance of national public ownership of IFIs to showcase ‘buy-in’ and ensure sustainability.

Barbara Dutzler, Senior Economist, JVI